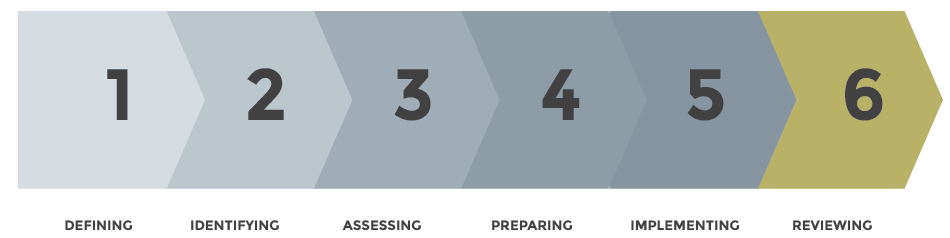

OUR PROCESS

We employ a simple, comprehensive process with all of our advice

1. Defining the Relationship

We explain what we do and give you the opportunity to ask us as many questions as you like (which you are free to continue doing at every step, of course). We make sure you that you are fully informed of our fees so that we can all be confident that any surprises down the track will be good ones!

2. Identifying your Goals

The best goals need to be long term– but all long term goals have short term components. So, we work with you to articulate what your longer-term financial position should be, and then lay out what that requires in the shorter term.3. Assessing you Financial Situation

This involves us making a comprehensive analysis of all of your financial information. We examine your assets, your liabilities, your insurances, your income and any changes to any of these factors that are likely to occur in the future.4. Preparing our advice

We take the time to provide you with a fully detailed, written statement of advice. This document is written in plain English and is reviewed by our licencee’s legal department to ensure that it is in your best interests.

5. Implementing the Recommendations

Once you have taken the time to read and digest the advice, we agree on a course of implementing the advice. This may involve things like organizing other professionals, such as lawyers, as well as you and we agreeing on who will implement which part of the advice.6. Reviewing the Plan

Things change. That’s why there is always a need to monitor your financial strategies to ensure they remain as effective as possible. We ensure that we do regular, formal reviews, and that we stay in regular contact with each other via our blogs and newsletters.